Not known Incorrect Statements About What Is 1031 Exchange California

Table of ContentsAn Unbiased View of Tax Shelter Real EstateA Biased View of 1031 Exchange FundThe 9-Minute Rule for 1031 Exchange Rules CaliforniaIndicators on 1031 Exchange California You Need To KnowThe 10-Minute Rule for What Is 1031 Exchange California

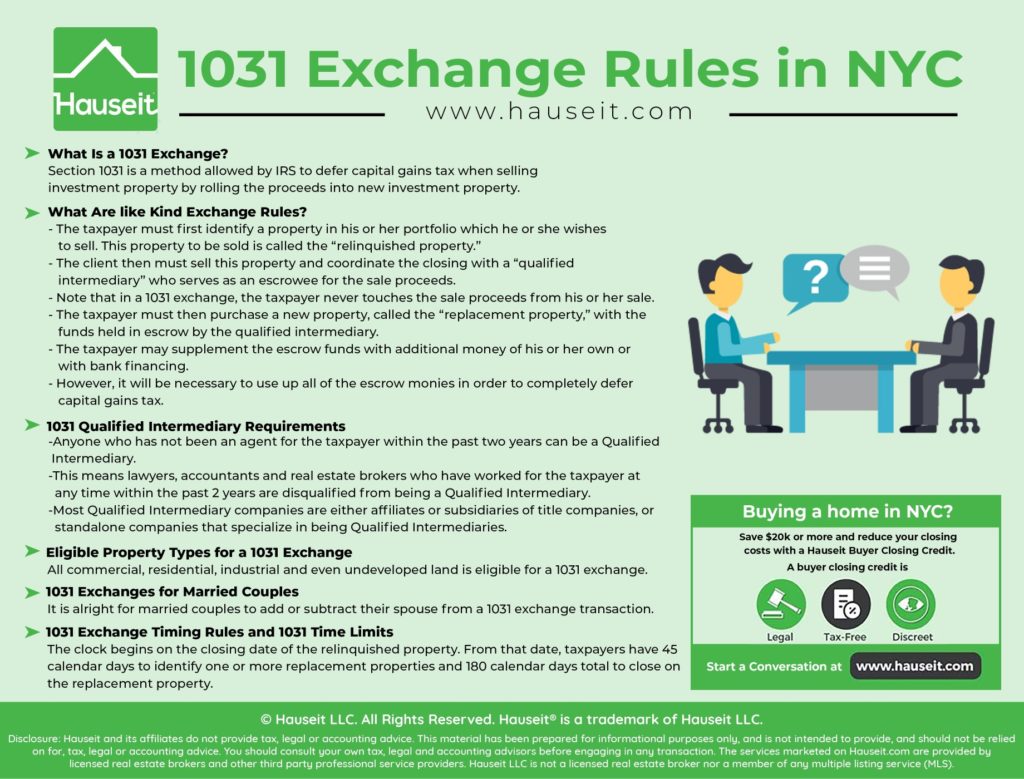

In property, a 1031 exchange is a swap of one investment property for another that enables resources gains taxes to be postponed. The termwhich obtains its name from Internal Revenue Code (IRC) Area 1031is bandied concerning by real estate representatives, title companies, investors, and football mommies. Some people even firmly insist on making it right into a verb, as in, "Allow's 1031 that building for one more." IRC Area 1031 has numerous moving parts that genuine estate capitalists must comprehend prior to attempting its use. Key Takeaways A 1031 exchange is a swap of properties that are held for organization or investment purposes. The residential properties being exchanged have to be thought about like-kind in the eyes of the Internal Revenue Service (IRS) for capital gains taxes to be deferred.The regulations can apply to a former main home under very details conditions. What Is Section 1031? Most swaps are taxable as sales, although if your own satisfies the needs of 1031, then you'll either have no tax obligation or minimal tax due at the time of the exchange.

That allows your investment to remain to expand tax obligation deferred. There's no limitation on exactly how regularly you can do a 1031. You can surrender the gain from one item of financial investment property to one more, as well as another, and also an additional. Although you may have an earnings on each swap, you prevent paying tax obligation till you cost money years later on.

All About 1031 Exchange California

To certify, many exchanges have to simply be of like-kindan enigmatic phrase that does not suggest what you believe it implies (Clicking Here). You can exchange an apartment for raw land, or a cattle ranch for a shopping center. The guidelines are surprisingly liberal. You can also exchange one business for another. However there are catches for the reckless.

There are likewise methods that you can make use of 1031 for switching getaway homesmore on that particular laterbut this loophole is much narrower than it utilized to be. To qualify for a 1031 exchange, both buildings must be found in the USA. Unique Guidelines for Depreciable Residential property Unique policies apply when a depreciable home is traded.

In general, if you switch one building for one more structure, you can avoid this recapture. However if you exchange enhanced land with a structure for unaltered land without a structure, after that the depreciation that you've previously claimed on the building will certainly be regained as ordinary income. Such issues are why you need specialist assistance when you're doing a 1031.

Getting My 1031 Exchange Fund To Work

Currently, only real building (or real estate) as specified in Area 1031 certifies. It's worth noting, however, that the TCJA complete expensing allowance for particular tangible personal residential or commercial property might aid to make up for this modification to tax law. The TCJA includes a change policy that allowed a 1031 exchange of qualified personal residential or commercial property in 2018 if the initial property was sold or the substitute property was obtained by Dec.

5 Easy Facts About Real Estate Investment Companies In California Shown

However the odds of finding somebody with the precise building that you want that desires the specific property that you have are slim. Therefore, most of exchanges are postponed, three-party, or Starker exchanges (named for the very first tax instance that enabled them). In a delayed exchange, you need a certified intermediary (intermediary), that holds the cash after you "offer" your property and utilizes it to "acquire" the replacement home for you.

The IRS says you can designate 3 residential or commercial properties as long as you eventually close on one of them. You have to close on the new residential or commercial property within 180 days of the sale of the old building.

The Buzz on Tax Shelter Real Estate

1031 Exchange Tax Ramifications: Cash Money and Debt You may have cash left over after the intermediary acquires the replacement building. If so, the intermediary will certainly pay it to you at the end of the 180 days. moved here. That cashknown as bootwill be tired as partial sales profits from the sale of your residential or commercial property, typically as a resources gain.

You need to consider home mortgage lendings or various other financial debt on the residential or commercial property that you relinquish, in addition to any financial debt on the substitute residential or commercial property. If you don't obtain money back yet your responsibility goes down, then that additionally will certainly be treated as earnings to you, much like money. Suppose you had a home loan of $1 million on the old property, yet your home loan see this page on the new building that you receive in exchange is just $900,000.